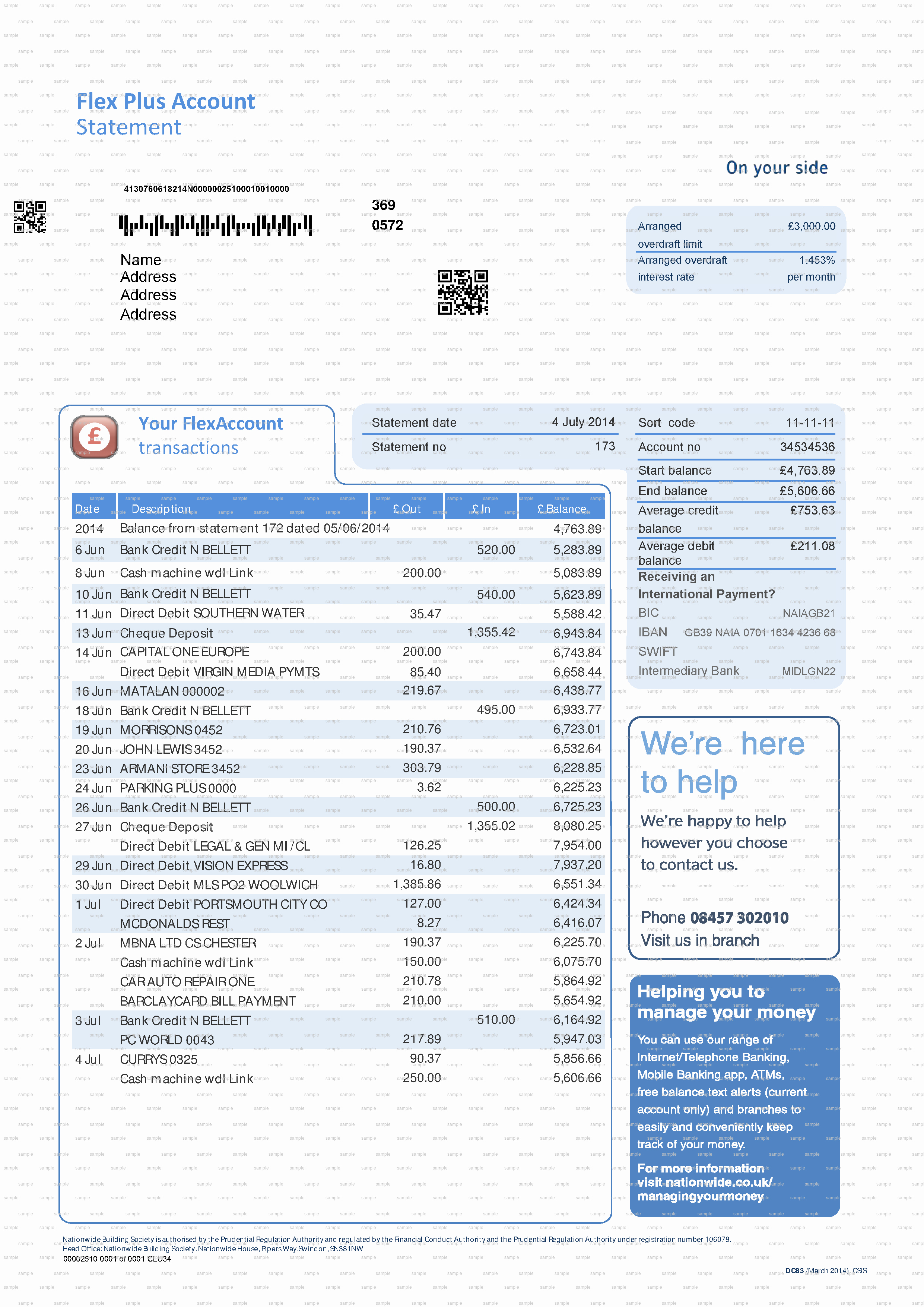

The more you can stay organized and on top of your own cash flow, the more solid your income proof. You can also generate your own personal paystubs with paystub creator to keep track of income, no matter your type of self-employment. Some of these services offer additional accounting assistance. If you conduct a lot of your business online, utilize a service (such as PayPal) that automatically tracks expenditures and deposits. It is a excellent approach to prove your income and business expenses down the line.Ĭlick Here to Create Your Paystub in Less Than 2 Minutes Make use of online accounting services that track payments and expenditures Setting up a separate account for business purposes alone is a perfect way to disassociate your personal and professional expenses and deposits. It can be easy, however, to misidentify certain expenses or deposits. Bank statements indicate personal cash flowīank statements are a great resource when it comes to tracking and proving income when you are self-employed. This means your tax return may not indicate a full representation of your entire income for a given year. Remember that many people sometimes don't record "off-the-books" income or smaller project fees. Keep in mind, however, that tax returns can have a downside for self-employed individuals. If you are a freelancer or business owner, you will receive the appropriate tax returns for a given year that state your annual income.

Tax returns are your first go-to when it comes to income proof. How to Show Proof of Income Locate all of your annual tax returns Check out these key steps to doing so, and get started today! Yet, proving your income is actually easier than you think.

This may seem daunting for self-employed individuals.

Showing proof of income is often required for loans, taxation laws, and insurance purposes. Self-employment doesn't mean you can forget about your credit responsibilities, however. You enjoy a flexible schedule and work that you like doing.

Being self-employed means employment on your terms.

0 kommentar(er)

0 kommentar(er)